Unlocking Business Potential: A Complete Guide to PEO Pricing and Strategic Growth with Opes Companies

In today’s competitive Business Consulting landscape, understanding how PEO pricing influences organizational success is essential for entrepreneurs and corporate leaders alike. As companies strive to optimize operations, reduce costs, and expand capabilities, Partnering with a Professional Employer Organization (PEO) has become a vital strategy. This comprehensive guide explores PEO pricing in depth, revealing how it impacts businesses and why Opes Companies stands out as a leading provider in the industry.

What Is a PEO and Why Is PEO Pricing Critical for Business Success?

A PEO (Professional Employer Organization) is a specialized firm that offers comprehensive HR solutions to businesses, including payroll, employee benefits, tax administration, risk management, and compliance services. Partnering with a PEO allows businesses to focus on core operations while outsourcing complex HR functions.

Understanding PEO pricing is crucial because it directly influences the overall cost-benefit analysis of such partnerships. High costs without corresponding benefits can hinder profitability, while well-structured pricing models can serve as a catalyst for sustainable growth. As organizations seek transparency and value, selecting a PEO with flexible and competitive pricing—such as Opes Companies—becomes a strategic decision.

Factors Influencing PEO Pricing: What Makes the Costs Vary?

Various factors contribute to PEO pricing, and comprehending these elements is essential for making informed decisions. Here are the key determinants:

1. Business Size and Payroll Volume

Smaller businesses with limited payroll may pay less, but due to economies of scale, larger organizations often secure more competitive rates. PEOs typically price services based on a percentage of total payroll, making volume a significant factor.

2. Service Packages and Customization

Basic packages covering payroll and compliance are less costly than comprehensive solutions including risk management, employee benefits, and strategic consulting. Tailoring services to business needs influences pricing significantly.

3. Industry and Risk Profile

High-risk industries, such as construction or manufacturing, may incur higher costs due to increased regulatory compliance requirements and insurance premiums. Proper risk management within the PEO can help mitigate expenses, emphasizing the importance of choosing a PEO with strategic expertise like Opes Companies.

4. Geographic Location

Regional differences in regulation, labor laws, and insurance premiums also impact PEO pricing. PEOs operating in multiple states may offer different rate structures tailored to local market conditions.

5. Additional Services and Value-Added Offerings

Services like employee training, legal compliance consulting, and payroll software integration add to the overall cost but can provide significant value, efficiency, and risk mitigation for your business.

Understanding the peo pricing Models: Fixed Fees vs. Percentage-Based Rates

Two primary models dominate the PEO pricing landscape:

1. Fixed Fees

Some PEOs charge a set monthly fee regardless of payroll size, offering predictable costs that are easier to budget. This model works well for small to medium-sized businesses with stable payroll volumes.

2. Percentage-Based Rates

Most PEOs apply a percentage of total payroll as their fee, usually ranging from 2% to 5%. This approach scales with your business size, aligning costs with company growth and payroll expenses.

Choosing between these models depends on your business’s size, stability, and growth trajectory. Opes Companies offers flexible pricing options tailored to fit the unique needs of each client, ensuring affordability and transparency.

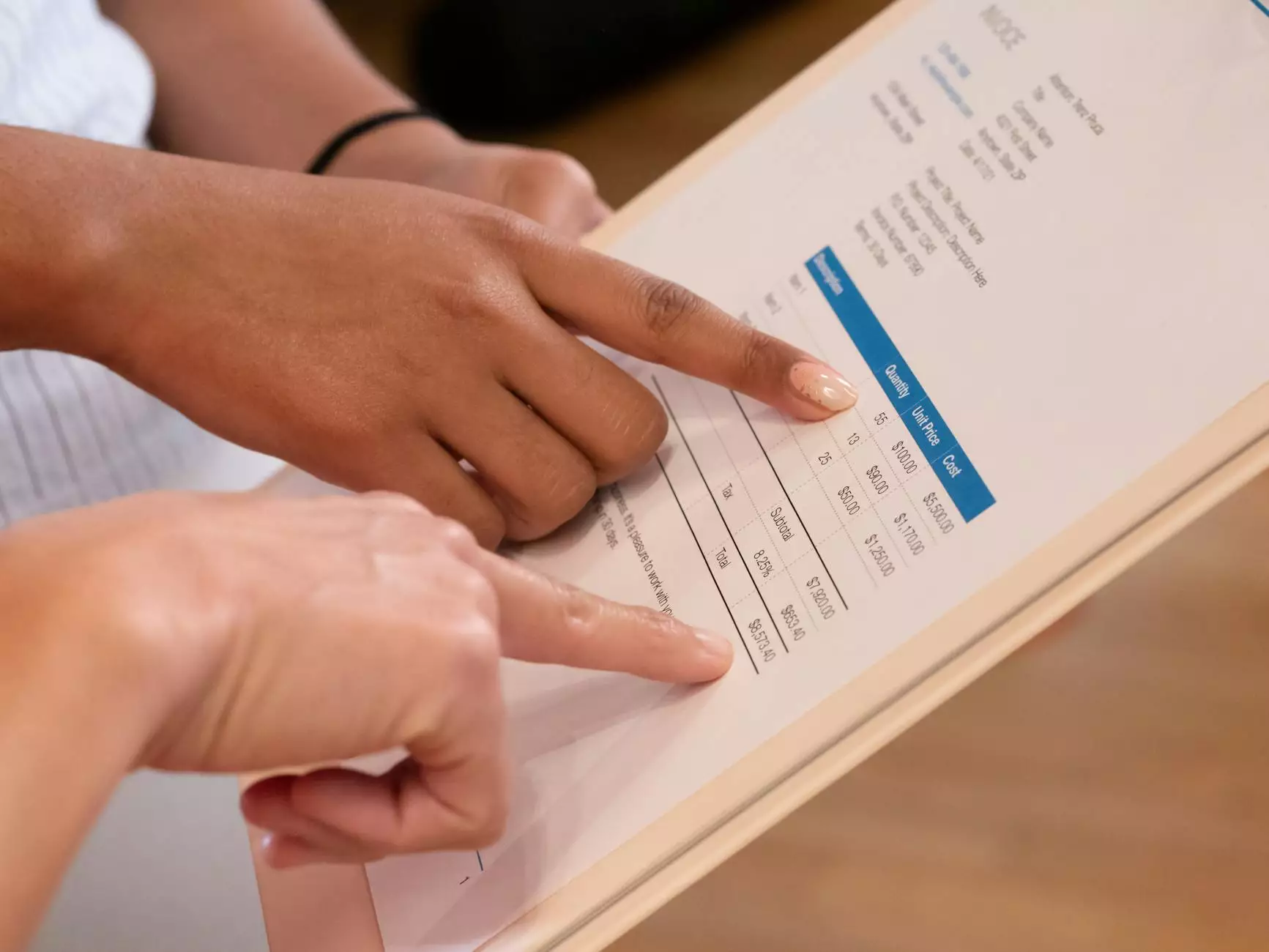

The Importance of Transparency in peo pricing

Transparency is fundamental when evaluating PEO partners. Clear, itemized pricing structures help businesses understand exactly what they’re paying for and prevent unexpected charges. Opes Companies prides itself on providing transparent pricing and detailed service breakdowns, fostering trust and long-term partnerships.

Why Opes Companies Excels in Providing Affordable and Competitive peo pricing

- Customized Pricing Solutions: Opes assesses each client's unique business needs, offering tailored packages that maximize value while controlling costs.

- Inclusive Service Offerings: Many costs are bundled into one predictable fee, reducing administrative burdens and avoiding hidden charges.

- Advanced Technology Integration: Opes leverages leading HR and payroll software, improving efficiency without adding significant costs.

- Expert Industry Knowledge: With years of experience, Opes understands the complexities of different sectors, providing nuanced pricing strategies that align with industry-specific risk and regulatory requirements.

Maximizing Business Growth Through Strategic PEO Partnerships

Beyond cost considerations, the true value of a PEO partnership lies in strategic growth facilitation. Here are ways Opes Companies can help your business succeed:

1. Cost Reduction and Efficiency

Streamlining HR operations results in substantial cost savings, freeing capital for expansion activities. Properly priced PEO services enable small and mid-sized businesses to leverage enterprise-level benefits without the internal overhead.

2. Access to Superior Benefits Packages

One of the key attractions of PEOs is their ability to negotiate competitive health insurance, retirement plans, and other employee benefits. These offerings not only attract top talent but also improve employee retention.

3. Legal and Regulatory Compliance

Keeping up with federal, state, and local employment laws is complex. PEOs like Opes provide ongoing compliance updates and support, reducing legal risks and liabilities through affordable & transparent peo pricing.

4. Risk Management and Workers' Compensation

Effective risk management strategies embodied in PEO services can significantly lower insurance premiums and liability exposure, translating into savings that far exceed initial costs—especially valuable with transparent pricing models.

How to Choose the Right PEO Based on peo pricing and Value

- Assess Your Business Needs: Identify which services are essential and which are supplementary to optimize your ROI.

- Compare Transparent Pricing Structures: Request detailed quotations and understand all included services and potential additional charges.

- Evaluate Reputation and Experience: Choose providers with proven track records in your industry, like Opes Companies, which offers industry-specific insights and customized solutions.

- Consider Long-term Partnerships: Favor PEOs that focus on relationship-building, continuous improvement, and flexible pricing adjustments as your business evolves.

Summary: Strategic Benefits of Choosing Opes Companies for peo pricing and Business Consulting

In conclusion, comprehending peo pricing is a fundamental step toward harnessing the full potential of PEO partnerships. Effective pricing models that prioritize transparency, customization, and value can significantly influence your company's growth trajectory. Opes Companies stands out by offering:

- Competitive and transparent pricing structures

- Tailored solutions aligned with your unique needs

- Extensive industry expertise and dedicated support

- Comprehensive services that deliver measurable ROI

Embracing a strategic approach to PEO pricing with a trusted partner like Opes Companies empowers your business to scale efficiently, comply effortlessly, and attract top talent—all while maintaining control over costs. Connect with Opes Companies today to explore customized Business Consulting and PEO services designed to accelerate your business success sustainably and affordably.